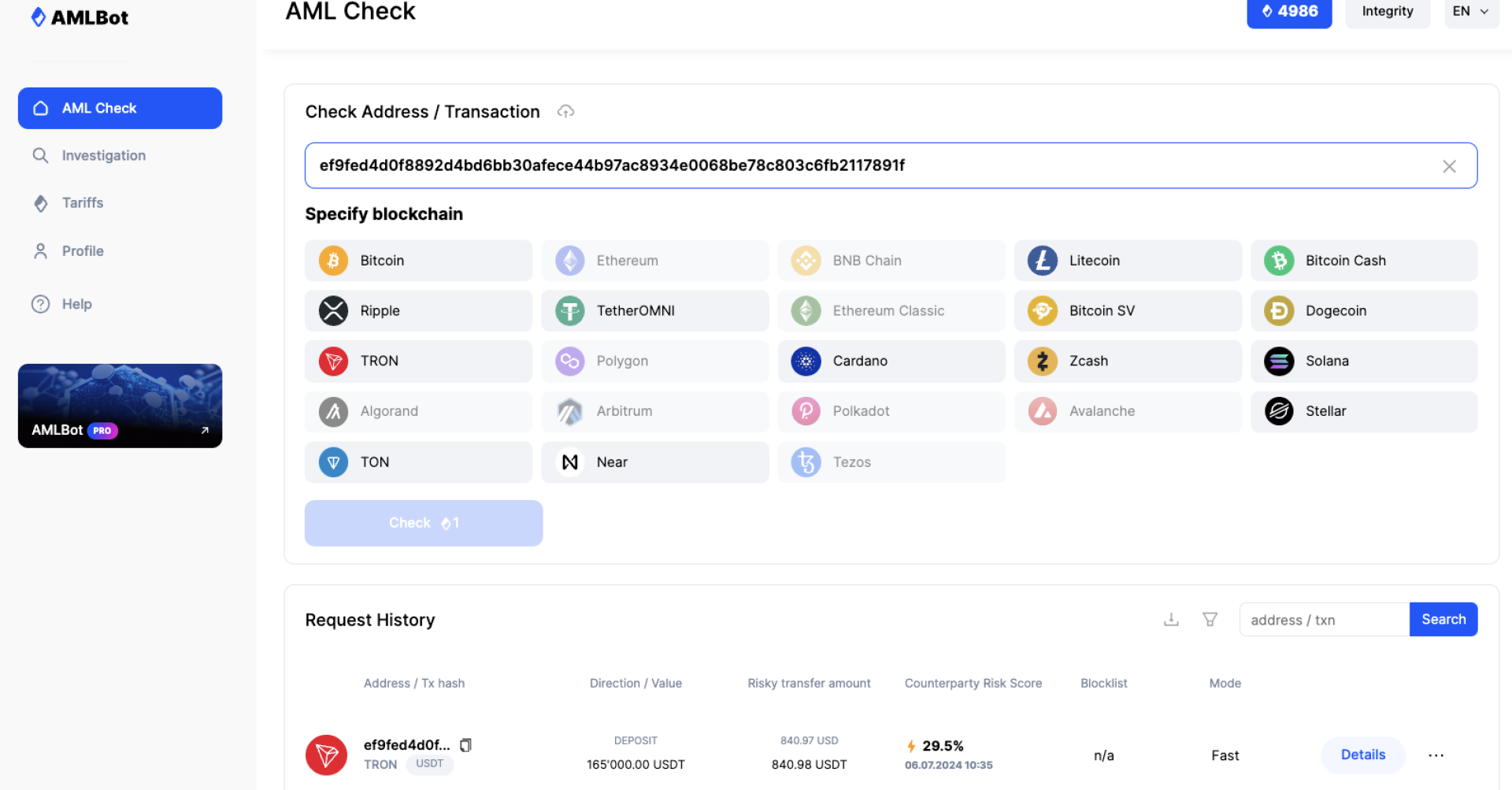

AMLBot implementation – KYT/Wallet screening service

In the world of cryptocurrencies, as well as in the financial world, some transactions and funds may refer to illegal activities. Not every one of our clients has sufficient technical knowledge and tools to be able to analyze their sources of crypto funds and the level of possible risk.

We have added AMLBot to our tools as a well-established cryptotransaction and address analysis service (KYT/Wallet screening).

Why AMLBot?

The main purpose of analyzing crypto transactions is to obtain complete information about funds marked as sanctioned, related to theft, extortion, payment for prohibited transactions, etc. The movement of funds between addresses in the blockchain allows to track with the original toxic addresses and the further related movement of funds from these addresses. In this way, we can check the funds in advance at the addresses from which planned funds can be received, or check the transactions and return the funds (or block it) if they turn out to be toxic.

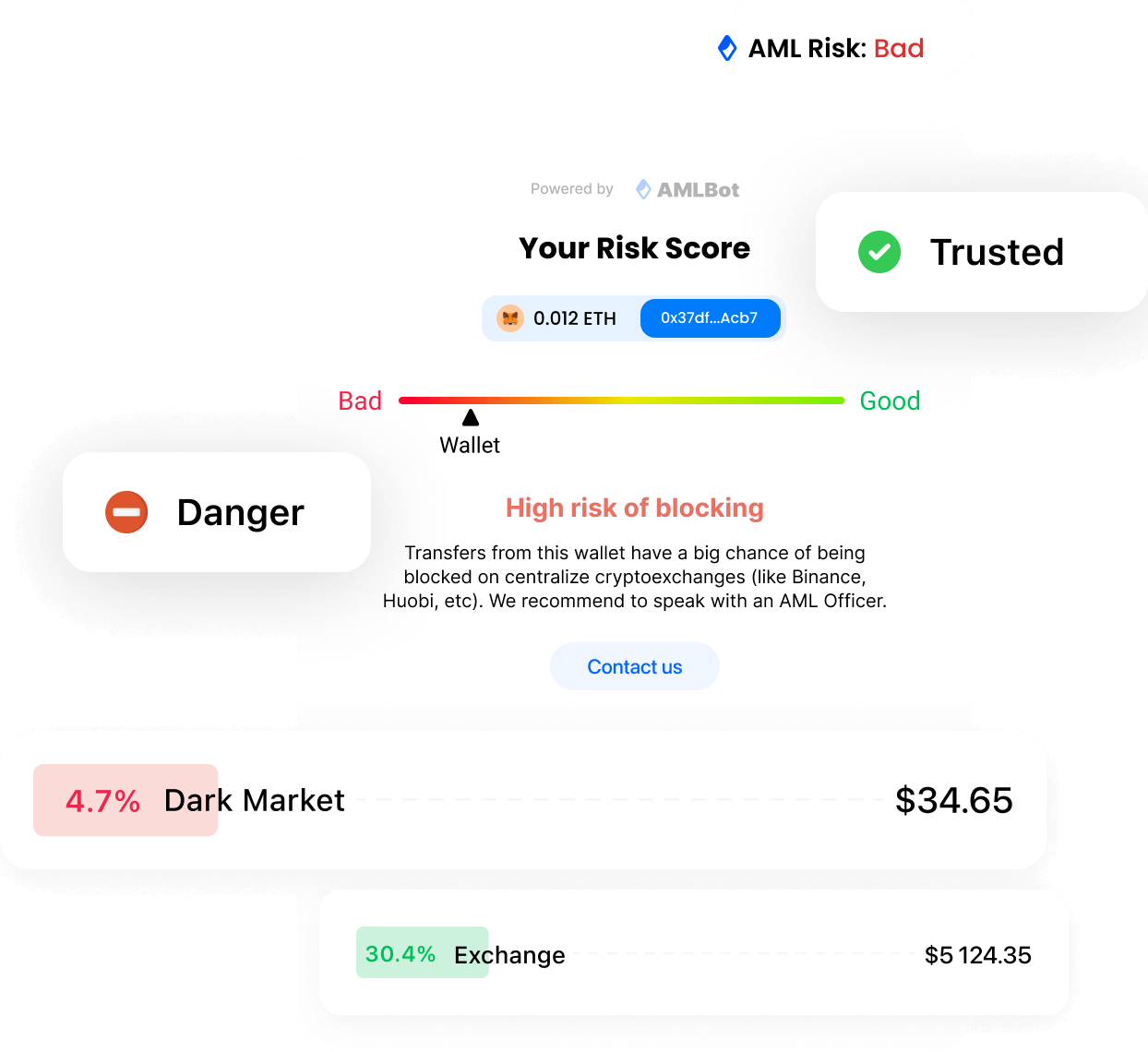

Address/Transaction Risk Level Report

| The result of the analysis is a report that determines the level of risk and shows as a percentage the composition of funds related to trusted sources, with a low level of trust and strictly prohibited. If long-term work is carried out with the client, the analysis of his transactions allows to understand the general profile of the client's source of funds and make a decision to suspend work with him. The client may also be given recommendations and training if he does not know all the intricacies of the blockchain and does not always understand where he receives funds from. One of the advantages of AMLBot is to provide a visual PDF report. |

What is a Risk Score

Risk Score is a metric that estimates the likelihood that an address/transaction is rellated to illegal activities. The value can range from High Risk (max. 100%) to Low Risk (min. 0%).

| Low RiskTransfer from the wallet should be safe. |

| Risk ZoneFrom 50% and above, there is a chance that transfers from this wallet can be blocked by centralized cryptocurrency exchanges (such as Binance, Kraken, etc.) or other reputable cryptocurrency businesses. We analyze the composition of the sources of funds and decide whether to process such transactions or not. |

| Extreme DangerTransfers from this wallet have a big chance of being blocked. |

AMLBot Identifies 38 Money Laundering Risk Sources:

Danger

| Child Exploitation | Persons associated with child exploitation. |

| Dark Market | Coins associated with illegal activities. |

| Special Measures | Entities or addresses identified by FinCEN as being of "primary money laundering concern". Countermeasures include recordkeeping, reporting requirements, and restrictions on fund transfers and account management. The scope may extend to similar authorities in other countries or jurisdictions as they are implemented. |

| Dark Service | Coins related to child abuse, terrorist financing or drug trafficking. |

| Enforcement action | The entity is subject to proceedings with legal authorities. |

| Fraud Shop | An entity that sells various types of data, including personal information, credit card information, and stolen accounts. Fraudulent transactions usually differ from darknet markets in their behavior, such as constant replenishment of deposits and no incoming transactions to customers. |

| Fraudulent Exchange | Exchanges involved in exit scams, illegal behavior, or whose funds have been confiscated by government authorities. |

| Gambling | Coins associated with unlicensed online games. |

| High-Risk Jurisdiction | The jurisdiction that is listed on the the FATF's non-cooperative list, has extensive malicious cryptocurrency activity or lacks a sophisticated regulatory environment. Including countries such as Iran, Venezuela, Albania, Russia and North Korea. |

| Illegal Service | Coins associated with illegal activities. |

| Illicit Actor/Organization | An organization or physical person who directly or indirectly participates in various forms of illegal activity. It is often associated with such risky topics as darknet markets, fraudulent transactions, extremist financing and hacking. |

| Mixer | Coins that passed through a mixer to make tracking difficult or impossible. Mixers are mainly used for money laundering. |

| Ransom | Coins obtained through extortion or blackmail. |

| Sanctions | Sanctioned entities. |

| Scam | Coins that were obtained by deception. |

| Stolen Coins | Coins obtained by hijacking someone else's cryptocurrency. |

| Mixer | Entities associated with terrorism financing. |

| Terrorism Financing | Coins obtained through extortion or blackmail. |

Suspicious sources

| ATM | Coins obtained via cryptocurrency ATM operator. |

| DEX | The blockchain application that facilitates cryptocurrency and token trading through automated smart contracts. Trades on the decentralized platform are peer-to-peer and have no third party or central authority other than the smart contract that executes the trades, making it a popular money laundering tool among malicious actors. |

| Exchange | High Risk | An entity becomes high-risk based on the following criteria: No KYC: Requires absolutely no customer information before allowing any level of deposit/withdrawal, or makes no attempt to verify that information. Criminal Connections: Criminal charges against the legal entity in connection with AML/CFT violations. Impact: High exposure to risky services such as darknet markets, other high-risk exchanges, or blending is defined as a service whose direct high-risk exposure differs by one standard deviation from the average of all identified exchanges over a 12-month period. Jurisdiction: based in a jurisdiction with weak AML/CFT measures. Unlicensed: Does not have any specific license to trade cryptocurrencies. |

| Infrastructure as a Service | The organization that offers computing and information services, including but not limited to VPNs, VPS and domain registrations. It could potentially represent a payment to privacy-focused providers that could be used for illicit purposes, but at the same time could represent a payment to completely legitimate business provider. |

| Lending Contract | The blockchain application that allows users to peer-to-peer lend and borrow crypto assets peer-to-peer without interacting with a third party or central authority. |

| Liquidity Pools | Smart contracts where tokens are locked up to provide liquidity. |

| P2P Exchange | High Risk | The organization does not have any special license to conduct business related to the provision of cryptocurrency exchange services, when participants exchange directly with each other, without intermediaries. It also includes entities that are licensed but located in listed jurisdictions, are listed as noncooperating companies by the FATF, or do not provide KYC for large-value transactions, making them attractive for money laundering. |

| Privacy Protocol | A protocol or entity that uses privacy features, such as zero-knowledge proofs, to provide users

with privacy features. Ensuring transparency of transactions, but at the same time, the addresses of counterparties remain hidden. This feature is the default behavior of many privacy-protecting cryptocurrencies such as Monero and Secret, meaning that gaining access to these assets does not necessarily mean that funds have been mixed or deliberately obfuscated. |

| Smart Contract | Blockchain functionality that functions like a self-executing contract, with the terms of the agreement between buyer and seller written directly into lines of code, executable without the need for a third party. |

| Token Smart Contract | The crypto asset that is built on another blockchain and that can be sent and received using a crypto wallet. There are various technical standards of agreed rules that guide the design, development, behaviour and operation of the given token. |

| Unnamed Service | The category refers to currently unidentified clusters that exhibit the behavior expected of a service, by a large number of addresses and transactions. |

Trusted sources

| Exchange | The organization allows users to buy, sell and trade cryptocurrencies by holding trading licenses that include the following aspects of the services: — Depository, brokerage or other related financial services that provide exchange services where participants interact with a central party. And does not include: — Licenses for non-specific financial services and jurisdictions included in the FATF noncooperative list. They represent the most important and most used category of entities in the cryptocurrency industry, accounting for 90% of all funds sent through these services. |

| ICO | The organization that crowdfunds its project by selling their newly minted cryptocurrency to investors in exchange for fiat currency or more common cryptocurrencies such as Bitcoin and Ether. There are many legitimate examples of these offerings, but also many cases where bad actors raise funds through ICOs, then they take the money and disappear. |

| Marketplace | The entity that allows businesses to accept payments from their customers, also known as

payment gateways or payment processors. It often faciliates conversions to local fiat currency and clearing the funds into the merchant's bank account. |

| Miner | Coins obtained through airdrops, token sales or other means. |

| Other | Smart contracts where tokens are locked up to provide liquidity. |

| P2P Exchange | The entity is licensed to conduct a business that is specific to providing cryptocurrency

exchange services where participants exchange directly with each other, without a middleman. It does not include non-specific financial services licenses and jurisdictions that are on the noncooperative FATF list. |

| Payment Processor | Coins associated with payment services. |

| Seized Assets | Crypto assets seized by the government. |

| Wallet | Coins stored in verified wallets. |

The AMLBot website also provides a lot of interesting information.

Contact us. We will explain to you in more detail the ways to check cryptotransactions for the risk level and verify your transactions upon request.