Online Payments

Streamlined and Efficient Settlements for Crypto Exchange Operations

Only some banks support payments associated with crypto exchange activities. During interbank transactions, these payments often undergo compliance checks at intermediary banks, introducing potential risks of blockages or delays.

We offer a traditional payment system featuring dedicated IBAN accounts and linked cards, enabling our clients to seamlessly manage their routine transactions with counterparties. Concurrently, clients can exchange crypto assets via the Integrity trading platform and execute payments within the Integrity payment system. These transactions are processed instantly, significantly reducing risks and ensuring smooth operations.

Experience the ease and reliability of our services, designed to meet your needs and enhance your financial operations. Please read the Account Opening Procedure.

Online Payment Services

Payment services are provided by EMERALD24, Emerald Financial Group (UK) Ltd, company No. 11557885, and LEGEX Ltd, company No. 15018265.

Emerald Financial Group (UK) Ltd is registered in England and Wales and authorised by the UK Financial Conduct Authority as an electronic money institution for the issuing of electronic money and provision of payment services (FCA reference No. 900908).

Legex is a company with extensive experience in fintech, online marketing and business consulting, which helps enterprises launch new businesses and implement modern IT systems in the field of international banking and payment processing, billing and settlement management, CRM and data management, website development.

By this way, our customers receive a comprehensive integrated platform designed to process payments of different profiles.

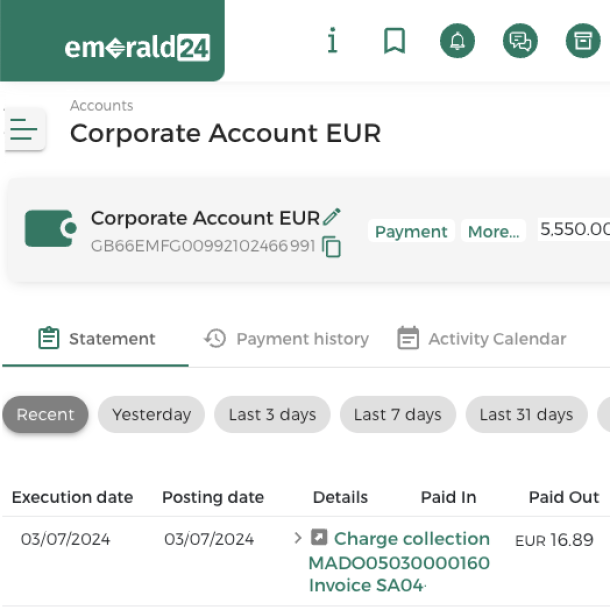

Dedicated IBAN

- International business or private account

- SEPA, TARGET2, and SWIFT payments

- Payments in GBP, EUR, USD, CNY and other currencies

- Multilanguage support

- Dedicated parsonal manager

Cards (coming soon)

- Contactless Mastercard payment card. Worldwide acceptance

- Payroll card for fastest and easiest payout service

- Phisical card delivery

- Virtual card for shopping online safely

Web and mobile apps

- Convenient web and mobile (coming soon) interface of the online bank

- Integration with the crypto trading system (coming soon)

- Optimization of payment routing and detailed reports

Full Compliance and Security

Emerald ensures the safety of your funds and personal information. Regulated by the UK Financial Conduct Authority (FRN 900908) since May 1, 2019, Emerald complies with both national and international standards, including the Wolfsberg Standards for international payments and electronic fund transfers. Client money is always held in safeguarded accounts with European banks, ensuring complete liquidity. Please note that Financial Services Compensation Scheme (FSCS) protection does not apply to e-money accounts.

Integrity provides crypto exchange services in accordance with European and Lithuanian legislation, applies integrated Sumsub (Crystal Blockchain) and AMLBot services, recognized by most regulatory authorities and financial institutions, automates the work of the AML/risk department and confirms a high level of compliance with regulatory requirements and commitment to international standards.

Please read the terms of payment services:

Account opening support

While opening a bank account seems like a straightforward process, many companies encounter challenges in document preparation, questionnaire completion, negotiations, and compliance issue resolution.

With our extensive experience in account opening, we possess in-depth knowledge of all procedures and paperwork requirements, ensuring a smooth and efficient process for our clients.

Streamline bank account opening with our expert assistance, ensuring your focus remains on business growth.

Please reach out to us if you have any questions.

And please read the Account Opening Procedure: